The Nuts-and-Bolts Financial Planning Challenges Behind a Vision to Change the World

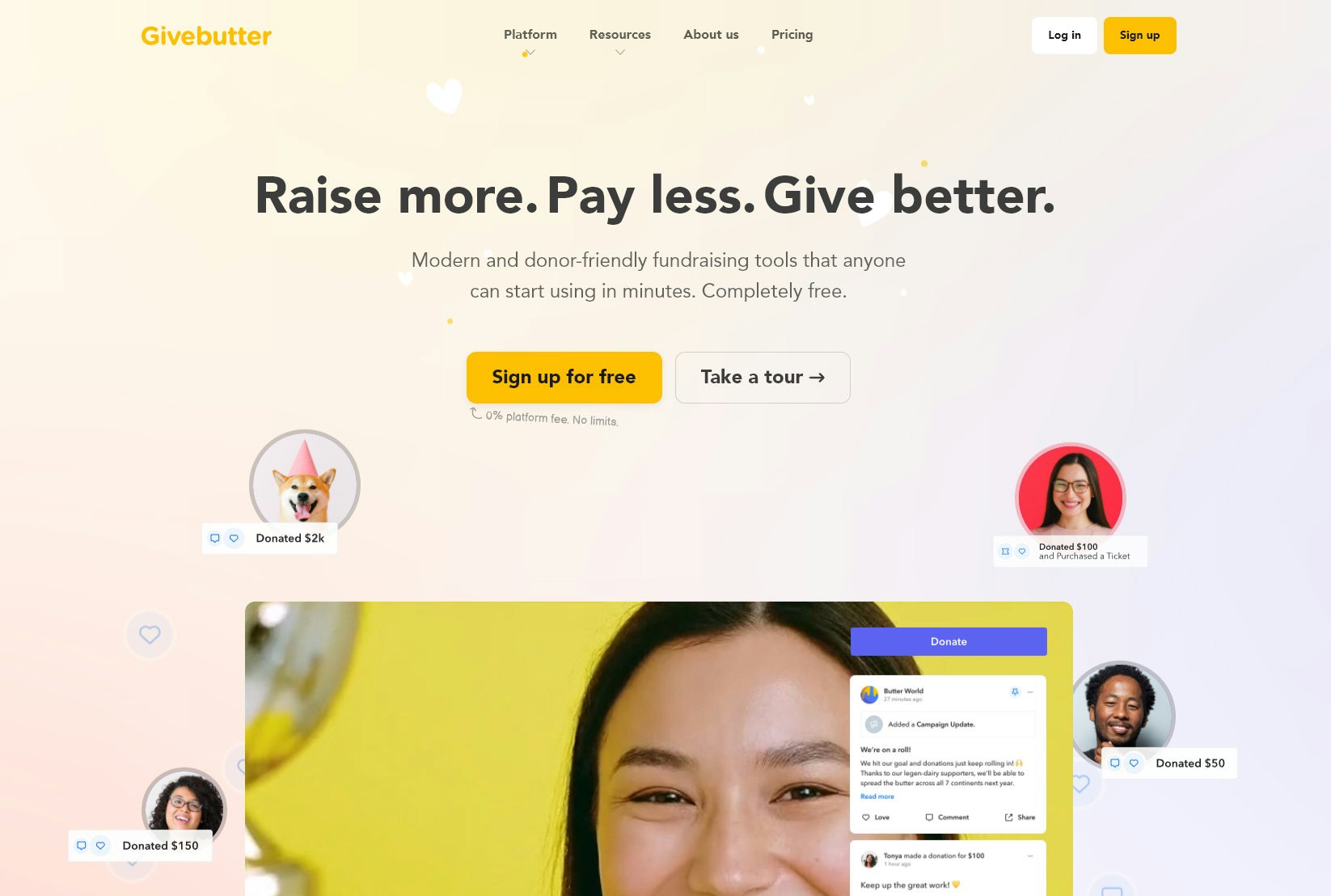

Givebutter: a platform for tech-savvy campaigners and nonprofits

Founded in 2016, Givebutter was created by three friends and entrepreneurs from their Washington, D.C. college dorm room. When they started out, they just hoped to help a fourth friend gather donations online.

Today, and with over $100 million raised on the platform, Givebutter is a free end-to-end fundraising platform, with features that do much more than drive crowdfunding campaigns. On Givebutter, customers might host a livestream, sell event tickets and memberships, collect recurring donations, and more.

In recent months, Givebutter saw campaigners raise for Hurricane Ida relief efforts, host art festivals, and support the resettlement of Afghan refugees.

Who manages the finances at Givebutter?

From 2016 until 2019, the company was just the three co-founders: CEO Max Friedman, Ari Krasner, and Liran Cohen. Today, it is a team of 25 people distributed across 14 states. Max, the CEO, remains highly involved in the financial planning, and day-to-day finances overall.

.png?ixlib=gatsbyFP&auto=compress%2Cformat&fit=max&lossless=true&max-w=1280&q=65)

.jpeg?ixlib=gatsbyFP&auto=compress%2Cformat&fit=max&lossless=true&max-w=1280&q=65)

Left: Max Friedman, Co-Founder & CEO

Right: Lucy Winterhalder, Head of People

Lucy Winterhalder, Head of People, also contributes to financial planning, especially when it comes to hiring. She owns updates to the roster of full-time employees and contractors, and the preparation of hiring forecasts.

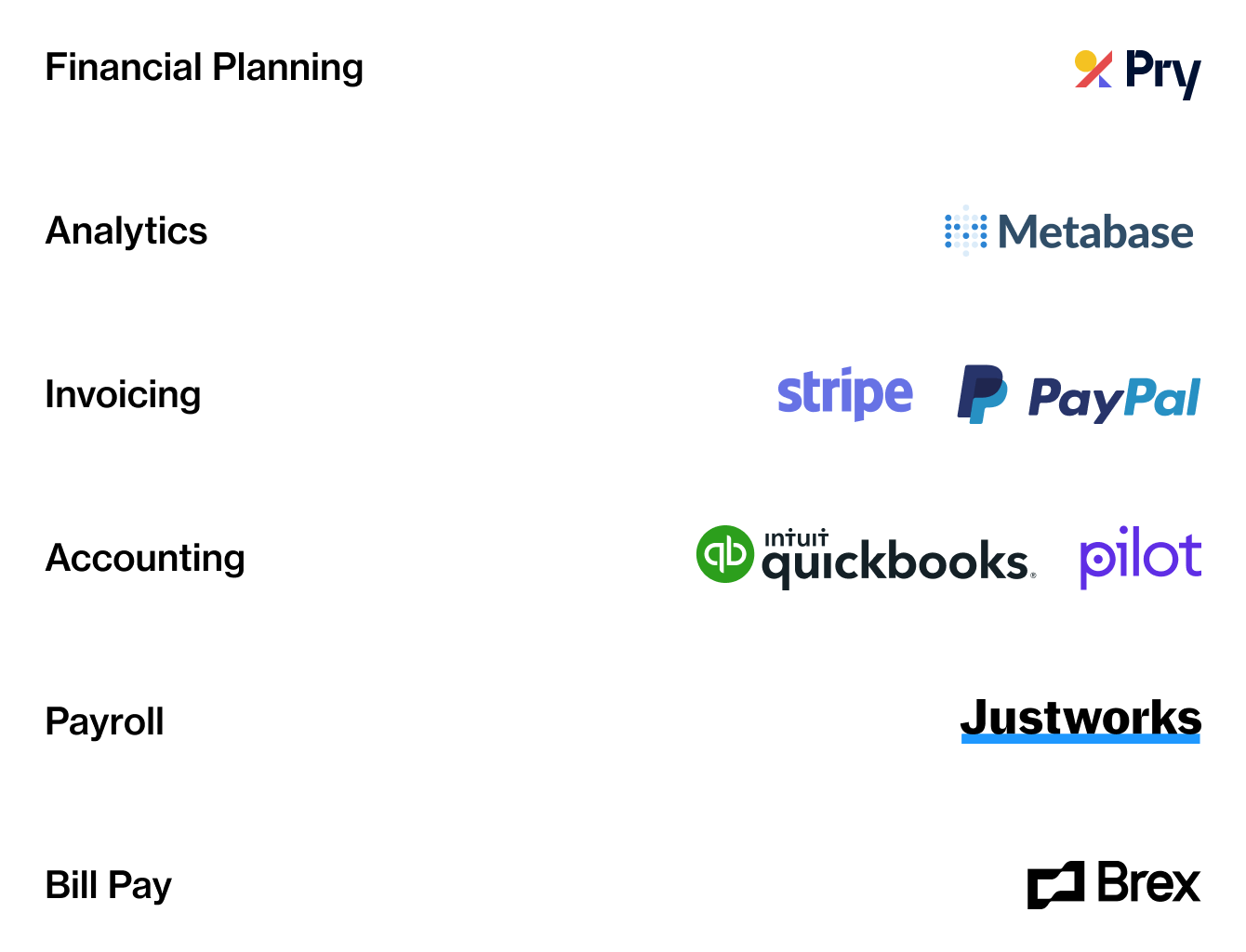

Givebutter’s finance stack

Financial Planning: Pry

Analytics: Metabase

Payment Processing: Stripe | PayPal

Accounting: QuickBooks Online | Pilot

Payroll: Justworks

Bill Pay: Brex

Before Pry: budgets that didn’t add up

At Givebutter, like at most startups, the financial picture changes quickly. Even basic cost and revenue drivers will change from month-to-month.

So when CEO Max Friedman and team were still doing Givebutter’s finances on spreadsheets, it was difficult to answer even basic questions about the company’s fiscal health.

Exact figures on cash flow and expenses were hard to get at, budgeting was tricky, and forecasts didn’t quite hit the mark. When decisions needed to be made, the spreadsheets didn’t help.

For example, did it make sense for Givebutter to spend on paid advertising?

Not to mention, Givebutter has only raised one small Angel round in 2019. Although it has historically oscillated between profitability and running at break even, without a cash pile in the bank, there’s no appetite for wasting money. It’s important for Givebutter to know exactly where it stands financially.

Interestingly, Max decided to pass on Pry the first time he was referred to the product by a friend who works as a chief financial officer.

“My first reaction was that our company was too far along for a tool like Pry,” he recalls. “I thought the tool would have been better when our company was just starting out.”

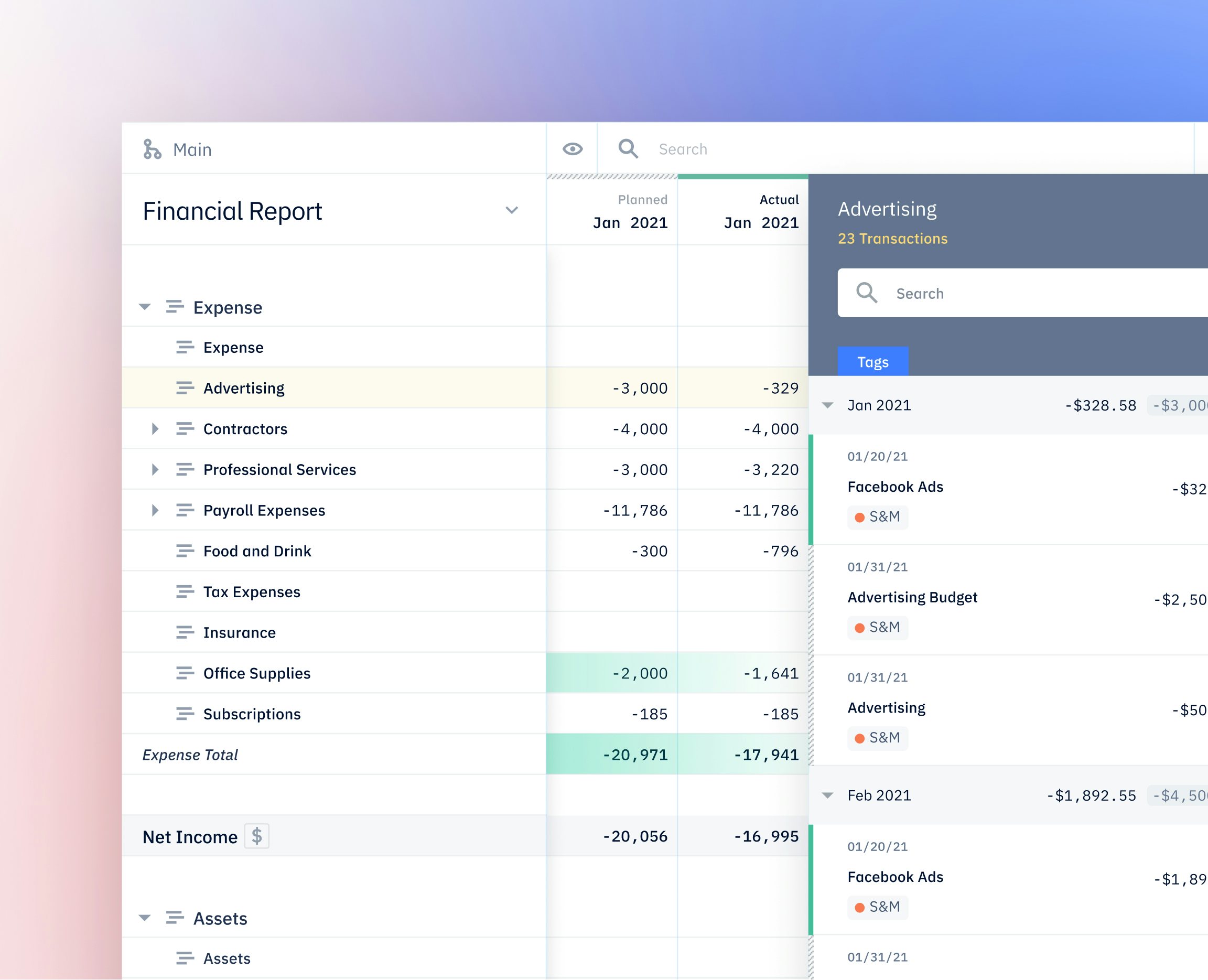

Pry in action: mastery of the financial details

Luckily, Max went back to Pry to give it a second try, and this time it stuck.

By then, Givebutter’s finance stack had evolved into a relatively complex operation. The team toggled between QuickBooks Online, Justworks for managing payroll, and more. Givebutter also relied on Pilot, a company that provides services in bookkeeping, tax, and R&D credits.

And all this infrastructure was integrated into the fundraising part of Givebutter. That side included Stripe for taking payments.

As a platform that handles a relatively large volume of funds itself, Givebutter’s financial picture can get complex. And, there is a seasonality to fundraising — nonprofits refer to the year’s final quarter as “Giving Season” — which creates unique financial planning challenges.

Despite the quirks in Givebutter’s finance stack and processes, Pry easily clicked into place and ingested all the data. The tool quickly emerged as a one-stop-shop for a comprehensive view into Givebutter’s finances.

For the first time Max, as Givebutter’s CEO, was able to see accurate revenue figures and expenses with a few clicks.

“The increased transparency into our business has saved me a lot of stress,” he says. “Before using Pry, our ability to drill down and see trends was very difficult.”

And Pry turned out to be a perfect complement to Pilot, the bookkeeping services provider.

Max leans on Pilot for “consultative CFO-type advice,” as he puts it, and general bookkeeping. Meanwhile, Pry is there for visibility into finances and fast updates, useful dashboards, and forward-looking planning tools.

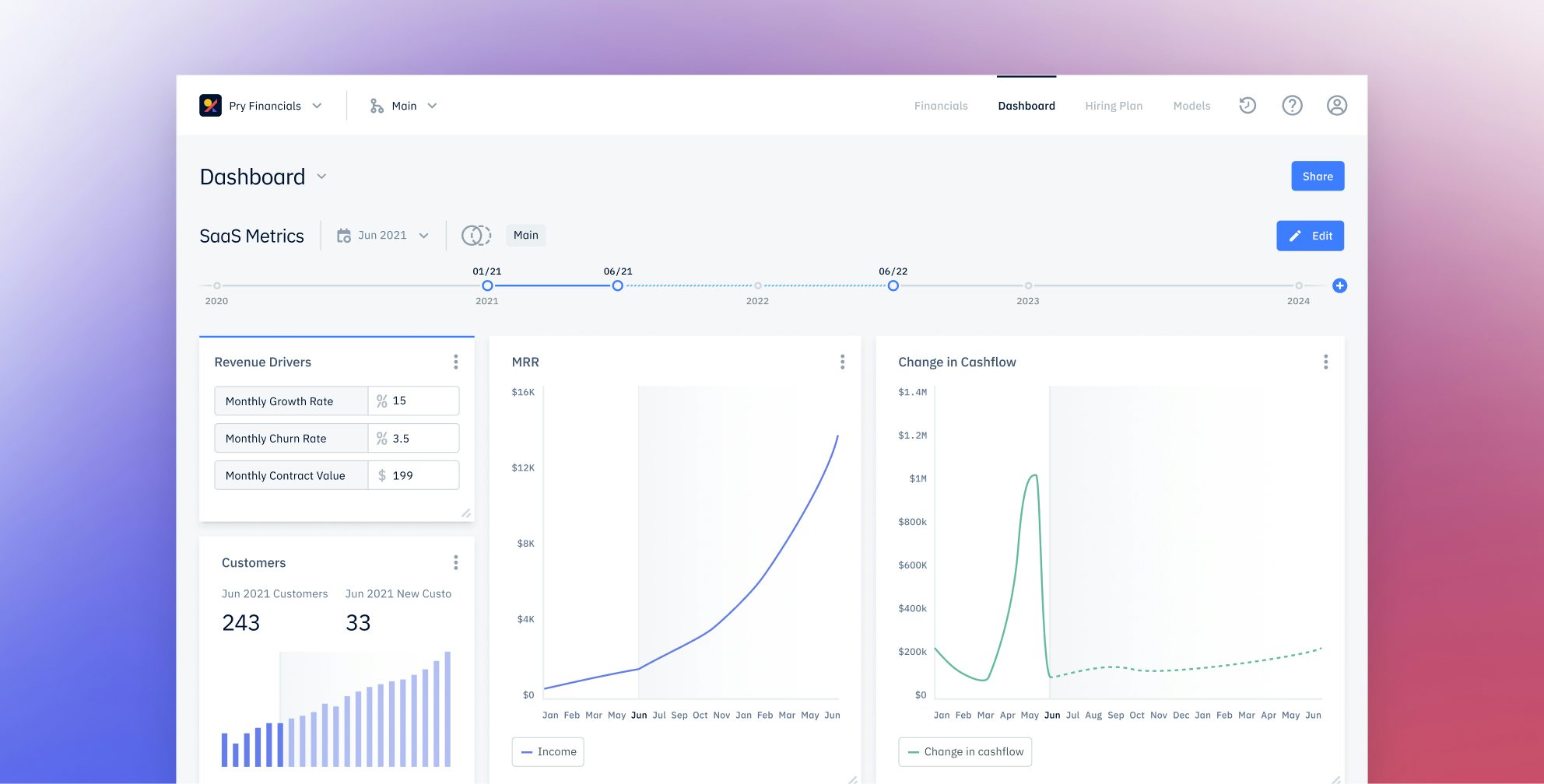

Pry in action: fully informed decision-making

In fact, Pry is particularly helpful for Max’s scenario-planning process. At any given time, when he’s making a decision about the future, he can go to Pry, and see best- and worst-case scenarios.

As well, he can easily zoom in for granular details or zoom out for the whole financial picture. Hiring and compensation planning, for example, are now informed by more than educated guesses.

Pry also allows him to do any number of other gut-check type tasks on the fly. He can make lightweight projections, look in on cash-flow, and see detailed cost readouts.

And, in these quick look-up scenarios, the data tend to be current because Pry makes it so easy to update the company’s financial information, without spreadsheets.

In other words, at any fork in the road, Max can quickly dive into Pry to view the decision through a financial lens.

And collaboration on decisions is made easier with Pry’s shareable visualizations.

“I love the ability to quickly share a dashboard with my co-founders, investors, and board,” says Max.

Suddenly, per-hire costs are immediately accessible and modelable at the click of a few buttons.

The Pry difference: Power and simplicity in financial planning

For a relatively seasoned leader of a startup focused on the nonprofit sector, Pry was a pleasant surprise.

“I didn’t expect Pry to be as powerful as it was. Pry saved me time, money, and stress, what's not to like," says Max Friedman, Givebutter CEO

If you’re a startup founder who wants a better and simpler way to organize your financial planning to advance your own mission, we’d love for you to try Pry out.

.jpg?ixlib=gatsbyFP&auto=compress%2Cformat&fit=max&lossless=true&max-w=1280&q=65)